BY TOM FAIL

SC STAFF WRITER

One of the fundamental principles of microeconomics is that rational consumers seek to maximize their utility when making purchases.

One does not typically go to the supermarket to purchase a dozen eggs and upon paying for these eggs, throw three or four of them away. Similarly, I have yet to observe students here at East Stroudsburg walk into the book store, purchase their books for the semester and immediately throw the macroeconomics textbooks into the trash cans on Normal Street.

However, on a daily basis, all across campus we see massive quantities of waste, misuse and utter irrationality when it comes to student’s investment in their college degree. Students seem to forget that every day they invest money to be here, they sacrifice opportunity costs of having a different job, and they are building a critical foundation for their future career.

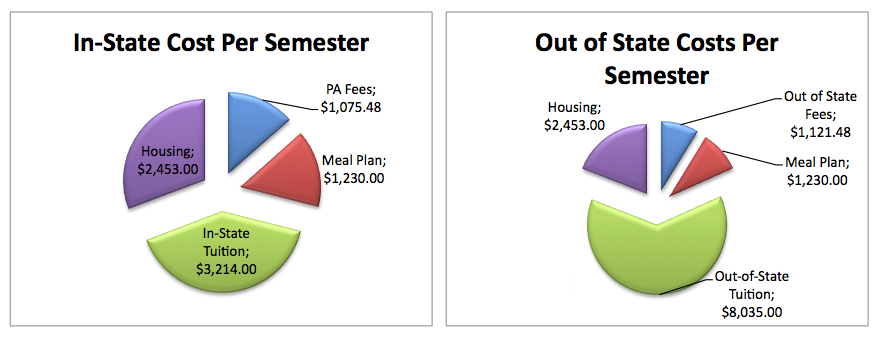

There are four primary expenses that students have while they are here—fees, tuition, housing and a meal plan.

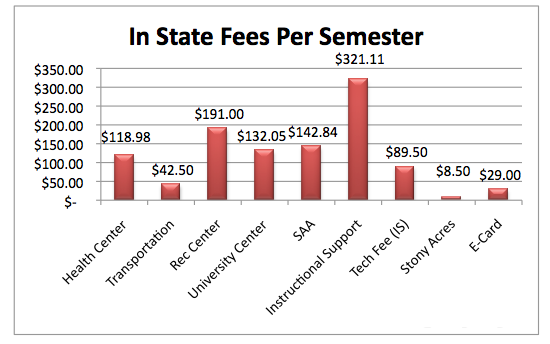

First off, fees are charged to all students during all sessions on a flat rate (prorated under 12 credits). The only fee that differs for out-of-state is the technology fee, and these fees go towards funding various services, amenities and resources that are critical to the university.

Second is tuition, which is charged at a flat rate between 12 and 18 credits with vastly different rates for out-of-state students. The discrepancy in payments is due to the amount of funds that the Pennsylvania State Legislature appropriates to subsidize educating Pennsylvania residents.

Third is housing, which for purposes of this paper is assumed to be a traditional residence hall on campus.

Finally, students have a meal plan or have to pay for food; throughout this analysis I assume a full meal plan of 19 meals weekly.

So just how much do ESU students pay every to attend school?

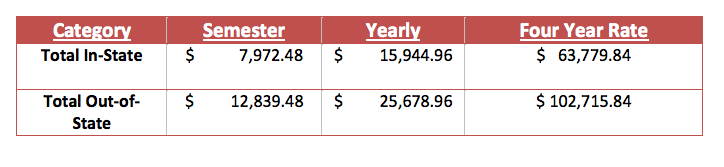

After four years, without financial assistance students can expect to invest almost $64,000 or $103,000 over the course of four years.

The accompanying pie charts show how these semester costs are distributed. As you can see, the growth in costs for out of semester students come from the 150% increase in tuition payments, and $46 extra dollars in fees charged to out of state students.

Finally, the accompanying bar graph tracks the costs of all the fees paid by ESU students per semester, with instructional support being the largest ($321.00) to Stony Acres being lowest ($8.50).

So what? The issue is that students often have no idea how much they pay per semester, let alone what they actually pay for. In surveying approximately 500 students that I have presented to, no more than 5-10% have known how much they pay per semester, and only 3 people have looked at exactly what their bill consists of.

There is an obvious disconnect between the consumer and their perception of the costs associated with attending ESU. Students are often tasked with simply focusing on their school work, and parents taking care of paying the bills (even if the student pays the loans in the end).

If students understood exactly how much they pay on a more elementary level, would they change their attitudes? This was the underlying question I had while creating my program, and I believe that it has a measurable impact.

Students cannot fathom the implications and payments necessary for a semester, year, or the total cost of a degree, so in the next section I will show some everyday scenarios that effect student behavior and demonstrate some of the costs incurred.

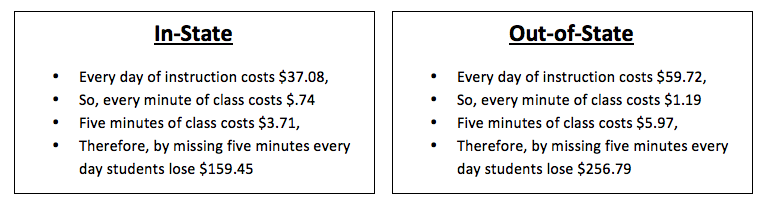

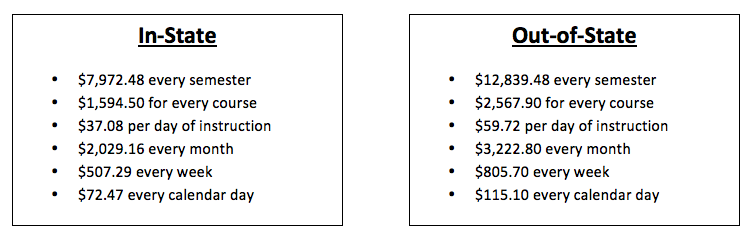

First, these figures are based on the assumptions of students taking 15 credits, paying fees, living in a traditional residence hall, and having a full meal plan. The first breakdown of costs is as follows…

So, young adults primarily ages 18-24 are incurring debt/paying between $500 and $800 a week to attend ESU. Every day here costs them between $72 and $115, and every month students pay between $2,029 and $3,222.

Yet, studies have shown that the amount of time students spend studying in comparison to previous decades has dropped nearly 50% and club and campus organization participation has decreased.

The consumer (students) has a fundamental disconnect with the true value of their education dollars. The following scenarios exemplify common occurrences on campus of student waste.

SCENARIO 1- A student decides to go out on a Thursday night and cannot make it to their three classes throughout the day on Friday. How much does that cost them in wasted payments?

Suddenly, a small night out turns into quite an investment when you account for missing three courses. Students do not directly pay $111.24 or $179.16, but they are missing out on this amount of instructional time that they have prepaid for. Simple solutions to this problem exist—waiting until the weekend, making sure they are rested and ready for class, or simply staying in for the evening all will help.

SCENARIO 2- A student struggles to wake up for their 8am class, therefore they come into class five minutes late everyday of the semester. This is no big deal, right?

By just showing up five minutes late every day, students waste between $159.45 and $256.79. All tallied throughout the semester, which accounts for 3 hours and 25 minutes of wasted instructional time as well. This statistic can be used to ensure that Professors are using time effectively as well.

Getting out of class early may be popular to students, but by doing so they are not maximizing their utility.

SCENARIO 3- All students love snow days—but how much does it affect the University delivering our education and making use of our investment?

Often times, students are angry that the administration will not call a snow day to close the University. Safety is paramount, but students do not considering the economic factors implied with cancelling every class for the day and the incredible number of active students in classes. For this example, I used Mondays in the Fall 2012 to analyze an approximate cost.

Every Monday there are 469 courses offered (259 meet MWF, 115 meet MW, and 96 meet weekly).

There are 14,787 active students within all of these classes.

Adjusting for the amount of course hours these warm bodies receive, the figure increases 19,401 hours of instruction.

Accounting for only the tuition and fees paid per student (Residence life does not kick them out of their dormitories nor deny them meal swipes), the cost per course hour is $19.06 for In-state students (which make up 77.4% of the population) and $40.70 for out-of-state students (which make up 23.7% of the population).

Therefore, it can be concluded that it costs students approximately $473,396.75 in wasted instructional time to cancel classes for just one Monday for the Fall 2012 semester.

Now that we have seen the statistics and costs associated with students investment here at ESU, we need to figure out how to inform students of the severity of their investment.

Students must understand that every day here is an opportunity that comes with a cost. Though we may not need to make a daily trip to Enrollment Services and forfeit our hard earned cash, we still pay. Families need to realize the specific costs to sending their child to college, and students need to be held accountable to maximizing their funds.

Financial aid has allowed many students to attend universities when they otherwise would have not been able to. In the words of Herbert Spencer, “the goal of education is not knowledge, but action.” Students do not come to college so that they have laundry lists of quotes, statistics and fun facts to share with the world—we come to better our lives and our communities.

Yet, even after hearing all of these statistics, seeing all of the charts, and putting themselves into all these scenarios, the campus will look like Mardi Gras the next time we get a snow day or professors let students out early from their dreaded 3 hour long class. I hope to change this sentiment, but as of now students remain the only consumers that actually want less for their money.

Email Tom at:

thf9988@live.esu.edu